The Thorny Issue of Pensions on Divorce

The Thorny Issue of Pensions on Divorce

The Pensions Policy Institute has recently published research on the impact of divorce on pensions in a paper entitled ‘Pensions and Divorce: Exploratory Analysis of Quantitative Data’. What can we learn from this report?

This research paper addresses, for the first time, the differences in pension wealth between married couples and also considers these discrepancies across gender, and different age groups, as well as different incomes and wealth distributions. The paper reveals that :

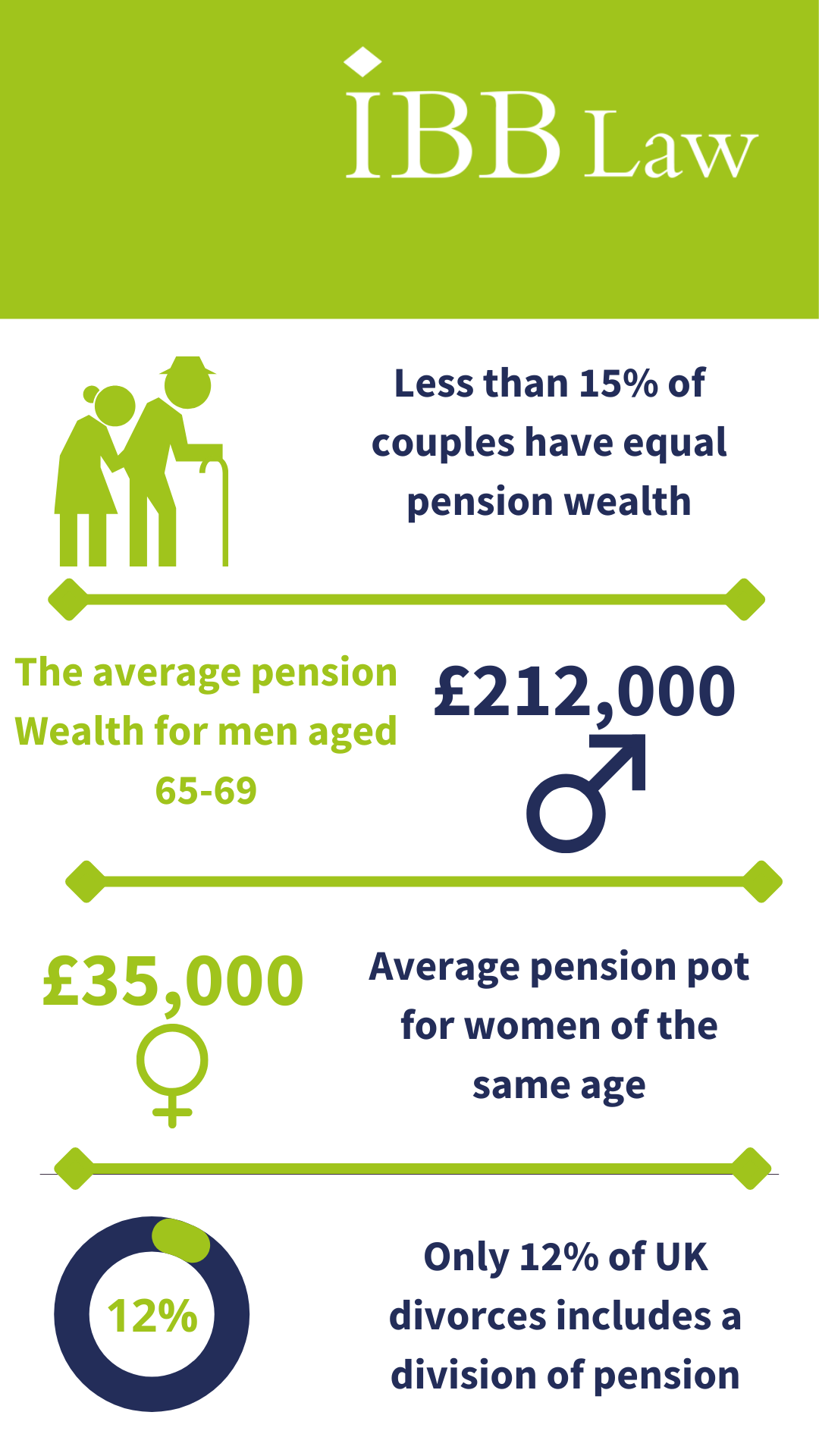

- There is a significant difference between the average pension wealth of men and women. The findings reveal that on average, men aged between 65 and 69 have pension wealth of over £212,000, whereas for women in the same age bracket the average is £35,000.

- Fewer than 15% of couples had pensions of approximately equal levels.

- According to the study, divorced women were particularly at risk of a reduced outcome, especially those with children.

So, why are we seeing these results?

Traditionally women have chosen to take on the role of homemaker/mother or reduce to part-time working with most men working full time. We suspect that if this same research is undertaken in 10 years, the stats will be different given the shift in traditions.

Traditionally women have chosen to take on the role of homemaker/mother or reduce to part-time working with most men working full time. We suspect that if this same research is undertaken in 10 years, the stats will be different given the shift in traditions.

As family lawyers, we often find that people are wary of considering pension shares because they simply do not understand what can be done with them. Instead, they focus on some other more tangible items that they would like to receive as part of the final settlement, say the family home. This can be particularly true for younger couples where retirement is not a pressing concern and therefore are not focusing on how their divorce may affect them several years down the line. This is often the case with women, who may focus on retaining the family home for themselves and the children, deciding that this would stand them in better stead for the future – leaving any pension out of the equation entirely. By doing this, they could be selling themselves short and, as the recent study reveals, this can contribute to divorced women being at risk of a reduced outcome. Obtaining accurate valuations of pensions is a vital part of the process of valuing assets, as is getting the appropriate expert advice at an early stage, as some employee pensions or final salary (defined benefit) pension schemes can work out to be even more valuable than the family home in the long run.

What can be done with pensions on divorce?

It is possible to share a pension, as you would with any other marital asset, for example the family home or savings. The appropriate decision as to what to do with the pensions will depend on the pensions involved as well as your own circumstances at the time. There are a variety of different orders that could be made in relation to the pensions involved, ranging from no order at all (where each party keeps their own pension), to pension attachment orders (where a set amount of pension is paid out to the former spouse once a pension goes into payment) or a pension sharing order (where a set amount of one party’s pension is taken out and invested into a separate pension scheme in the other party’s name). It is also possible to offset a pension’s value against other assets when calculating the division of matrimonial assets on divorce. Even if a pension is in payment, it is still possible to carry out any of these options. However, despite the fact that these options are all available, the most recently published official statistics reveal that only 12% of divorces result in any pension division.

Looking at the results revealed by the recent pensions report, pensions are clearly a potentially lucrative asset that may be overlooked on divorce, particularly if parties are endeavouring to reach a financial agreement independent of professional help. The introduction of compulsory workplace pension schemes in 2012 has contributed to pensions becoming increasingly valuable assets and this is something that is only going to increase going forward. Given their complexity, it is vital that you seek advice at an early stage if you have concerns about your own or your spouse’s pension.

Speak to our Family Law Experts

At IBB Law the family team act for both men and women in terms of pension preservation or pension claims. Our expert team will guide you through the complex issue of pensions on divorce and will always recommend that a Pensions on Divorce Expert is instructed.

Catherine O’Reilly is an Associate Solicitor in the team and specialises in advising couples going through a divorce. Catherine can be contacted on 01494 790068 or catherine.oreilly@ibblaw.co.uk.