Property Sales Above IHT Nil Rate Band Hit Record High

Property Sales Above IHT Nil Rate Band Hit Record High

Property sales above the IHT nil rate band are at a record high, according to new research.

Saga Investment Services has said that more than one in four properties sold in England and Wales now exceed the single person IHT nil rate band (NRB) of £325,000. The study, which analysed data from 105 postcodes through England and Wales, found central and outer London to be the biggest areas for growth.

According to Saga, the number of properties in the capital sold above the threshold increased from 34% in 2009 to 72% this year. Almost all homes (95%) sold in the eastern central area of London were more than the NRB.

Gareth Shaw, head of consumer affairs at Saga Investment Services, suggested the new main residence allowance will give people in property hotspots "welcome relief" but acknowledged it will introduce more complexity to the already-confusing UK tax landscape: "For anyone who believes their estate may be subject to IHT, early action with a professional financial planner will be a valuable investment,” he added.

Overall, there has been a small rise in the proportion of properties sold for more than £650,000, the maximum that can be passed on by someone who inherits any unused IHT allowance from their spouse or civil partner.

IHT nil rate band static despite more millionaires

It is estimated that there will be 495,000 millionaires in Britain by the end of 2016, and 600,000 by 2020, according to the research prepared by financial services provider NFU Mutual.

Analysis of HM Revenue and Customs' UK Personal Wealth Statistics indicates that the number of millionaires is growing by over a quarter every three years and may lead to many more people paying inheritance tax given the nil rate band will remain frozen at £325,000 until 2021.

"These figures show that the taxman is set to take an ever greater slice of people’s estates over the next few years as house prices and share prices have boosted the wealth of the nation," said Sean McCann, a chartered financial planner at NFU Mutual.

From April 2017 the tax-free allowance on a family home for inheritance tax purposes will be introduced and this will rise from £100,000 to £175,000 by 2020. "By which time it will be possible for a married couple to leave up to £1m free of inheritance tax," Mr McCann added.

Baby boomers planning to spend their kids' inheritance

A new study, for Gransnet, has found that one in six 50-70-year-olds is planning to spend every penny of their cash before they die, leaving nothing to their children.

It reflects the findings of a separate study in February, which highlighted that people in their early 40s expect an average inheritance of £180,217, with one in ten planning to fund their entire retirement from an inheritance. In reality, the study found, they were set for an average inheritance of £69,871.

Housing Minister champions "disinheritance" to help first-timers

Gavin Barwell, the Housing Minister, has suggested that parents could disinherit their children, leaving their homes and wealth to their grandchildren instead in a bid to help young people get onto the property ladder.

Mr Barwell acknowledged that his own mother had recently “disinherited” him and will instead pass her estate, and £750,000 home, to three of his own children and two of his nephews.

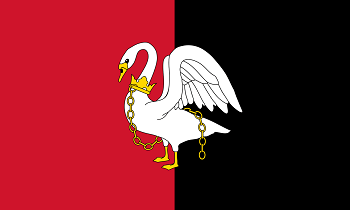

Buckinghamshire's wills, trusts and probate experts

For advice on issues relating to wills, trusts, probate and tax and inheritance tax and estate planning, please contact our specialist lawyers today on 03456 381381 or email enquiries@ibblaw.co.uk.