UK Contentious Probate Regional Report 2022

UK Contentious Probate Regional Report 2022

We asked 1,000 UK citizens who had dealt with an inheritance dispute various questions, and these were the results…

When someone passes away and leaves behind a Will, their loved ones may be entitled to dispute its validity. Depending on the circumstances, this could be done for a number of reasons.

Following up on our original report into Wills, inheritance and probate disputes involving UK residents, we have now taken a detailed look at how statistics regarding contentious probate compare across different regions in the UK. Read on below for a closer look…

Table of Contents

- Overview of key statistics

- Number of Will disputes

- Which family members are the focus of Will disputes?

- Average inheritance

- Claiming for non-family members

- Reason for dispute

- Legal fees

- Outcome of inheritance claim

- Debt

- Inheritance act

- Methodology

Section 1: Overview of key statistics

The survey asked citizens from the UK and Northern Ireland about their experiences dealing with contentious probate and inheritance disputes. Although Scotland and Northern Ireland do not have the same legal system as England and Wales, the data for each country has been included for comparative purposes, to get a sense of the picture across the whole of the UK.

The following is an overview of some the key statistics from the survey that will be discussed further:

- Northern Ireland has the highest proportion of residents who have been involved in two Will disputes in the past 10 years (48%).

- The North East has the highest proportion of residents who have been involved in more than two Will disputes in the past 10 years (30%).

- Glasgow is the city with the highest proportion of residents who have been involved in more than two Will disputes (17%).

- Almost 1 in 5 inheritance disputes in the South East were relating to the fathers’ Will (19%).

- Colleagues made up the highest proportion of non-family members who initiated an inheritance dispute in 50% of regions in the UK, including South East (59%), South West (55%), East Anglia (40%), East Midlands (40%), North East (33%), and Wales (33%).

- The West Midlands has the highest average value of inheritances in the UK (£283,360.50).

- The East Midlands has the lowest average value of inheritances in the UK (£52,787.80).

- Oxford is the city with the highest average level of inheritance in the UK (£706,364.10).

- Wrexham is the city with the lowest average level of inheritance in the UK (£47,125.50).

- The North West is the region with the highest percentage of people spending more than £50,001 on legal fees (8%).

- Manchester is the city with the highest percentage of residents spending more than £50,001 on legal fees (19%).

- Plymouth is the city with the highest percentage of people spending less than £1,000 on legal fees (29%).

- Residents from the North West were more likely to claim more than £1,000,000 from an inheritance claim than any other region.

- The North East has the highest percentage of claims worth between £500,001 and £750,000.

- 21% of successful claims relating to residents from Manchester were worth more than £1,000,000.

- Newcastle has the highest percentage of residents successfully claiming between £500,001 and £750,000 (19%).

- The South West has the highest proportion of estate debts worth between £100,001 to £300,00 (36%).

- The most common type of debt in London was credit card bills and mortgages.

- The most common type of debt in the South West was rent arrears.

- 100% of respondents from Wrexham claim to be aware of the Inheritance Act.

- 27% of respondents from Belfast have heard of the Inheritance Act, which is the lowest out of any UK city.

Section 2: Number of Will disputes

There are a range of interesting findings relating to the number of Will disputes participants in the survey claim to have been involved in over the previous 10 years. Whilst every region in the UK saw the majority of participants claiming to have only been involved in one Will dispute over the past 10 years, the exact percentages varied significantly.

Number of Will Disputes by Region

When discussing regions, Yorkshire and the Humber had the highest proportion of residents who had been involved in just one Will dispute in the past 10 years (77%).

After Northern Ireland, the East Midlands had the highest percentage of residents (43%) who had experienced two will disputes in the past 10 years.

The North East had the highest percentage of residents who had been involved in more than two Will disputes in the past 10 years, at 30%. It is also interesting to consider that the North East also had the lowest percentage of people who have been involved in two Will disputes (16%).

Number of Will Disputes by City

There are a number of notable trends when taking a deeper dive into the statistics for individual areas that lie within these regions.

After Edinburgh (89%), Southampton is the area with the highest proportion of residents who have dealt with one disputed Will over the past 10 years (86%).

In England and Wales, Brighton and Hove is the area with the highest proportion of residents who have dealt with two Will disputes in the previous 10 years (68%).

Newcastle is the area of the UK which has the highest percentage of residents who have dealt with more than two Will disputes in the previous 10 years (32%).

Section 3: Which family members are the focus of Will disputes?

Most of the time, Will disputes typically involve people who had some form of relationship with the deceased – familial or otherwise. Previous insight we have reported indicates that, in general, you are most likely to experience a dispute in relation to your father’s Will rather than any other relation – but the results in each region don’t necessarily follow this pattern.

There were four regions in the UK which followed the expected pattern. In the South East, and the West Midlands, Will disputes over fathers’ Wills were the most common compared to any other relation. The South East had the highest proportion of disputes relating to fathers’ Wills (19%).

Fathers’ wills were also the most commonly disputed in London (11%), the North East (14%), and the South West (14%). However, in London, fathers of the survey respondents, as well as wives, were the most commonly disputed wills, while in the North East and the South West, it was the father’s wills and paternal grandmother’s that were the most commonly disputed.

Section 4: Average inheritance

Average Inheritance by Region

The West Midlands, the North West, the South West, and London are the four regions in the UK where the average inheritance is significantly higher than the remainder:

- West Midlands – £283,360.50

- North West – £242,376.90

- South West – £216,319.90

- London – £202,902

The remaining regions in the UK all sit well below this (East Anglia, East Midlands, North East, Northern Ireland, Scotland, South East, Wales and Yorkshire and the Humber):

- Northern Ireland – £138,868.90

- Wales – £113,974.80

- North East – £106,828.10

- South East – £101,446.90

- East Anglia – £ 97,425.50

- Yorkshire and the Humber – £91,597.20

- Scotland – £90,97.60

- East Midlands – £52,787.80

Given that residential properties often form a substantial proportion of an estate’s value, a sensible hypothesis would be for areas which have higher average house prices to also have the highest value inheritances. In some cases, this proves true.

As expected, given the average cost of living and annual wages, London has the highest average house price in the UK at £521,146 (as of December 2021). It is, however, interesting that London does not have the highest average inheritance, sitting in fourth place.

Similarly, the South West also follows this expected trend. Latest figures demonstrate that it has the fourth highest average house price in the UK (£314,037) and it is similarly within the group of the four highest regions for the value of inheritances.

The North West and West Midlands do not follow this trend as closely. While both have high value levels of inheritances, the average house prices for both areas are below the overall average in England (£293,339).

The other major outlier is the South East. This area has the second highest average house prices in the UK (£380,237), but the average level of inheritance is well below what may be expected (£101,446.90).

There are a number of potential reasons for this, starting with the number of children that people may have, which would naturally reduce the level of individual inheritances in larger families. What’s more, the growth of blended families could also have some impact here, as the more family members, the more beneficiaries there are likely to be splitting the estate.

We can only speculate as to these reasons, but it’s certainly interesting to compare the areas where these reasons have perhaps less impact.

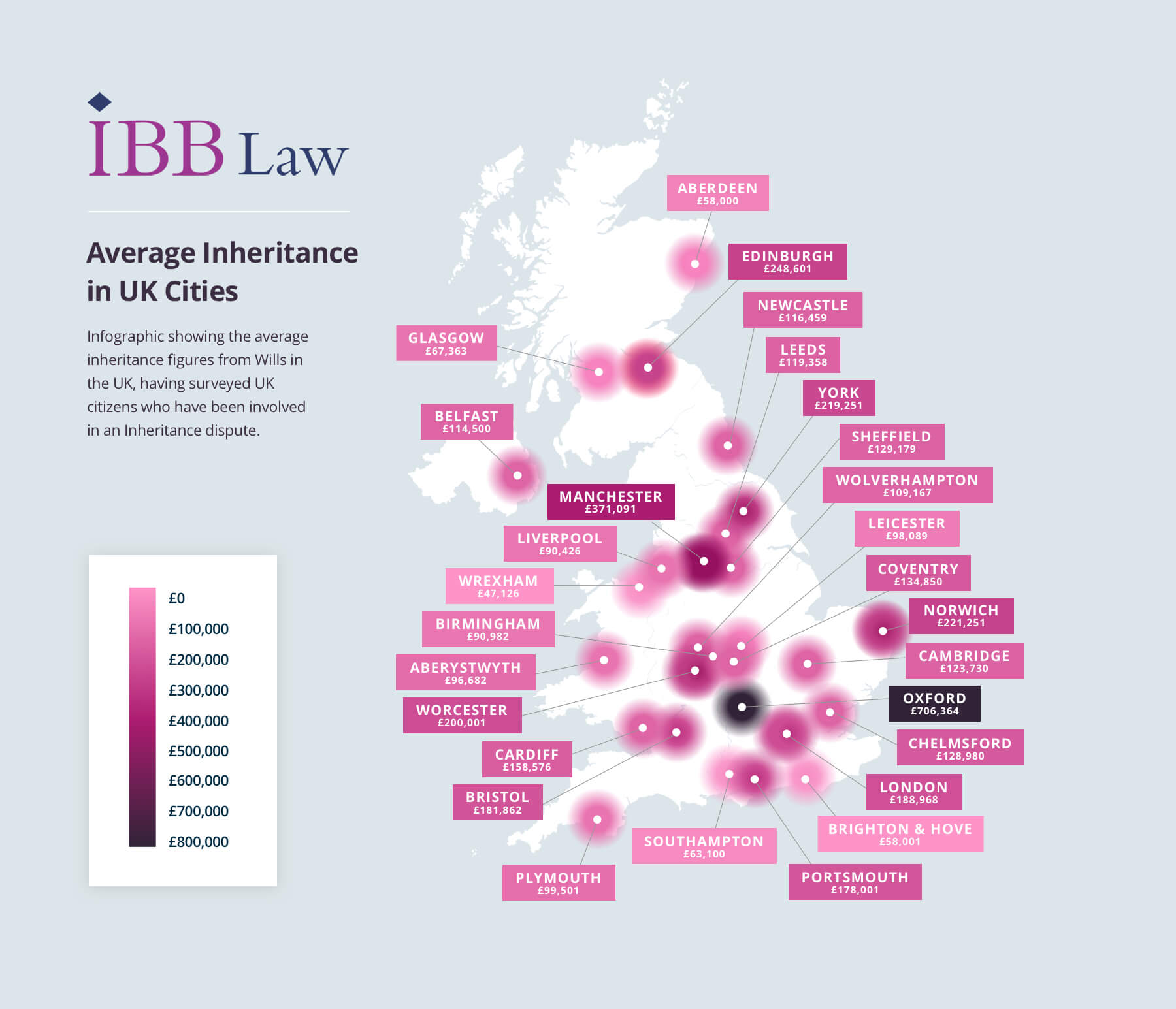

Average Inheritance by City

The statistics can be broken down further based on cities. This infographic gives you an idea of which UK cities are seeing the highest and lowest average inheritance values:

As you can see, the following cities have the highest level of inheritance per person:

- Oxford

- Manchester

- Edinburgh

- York

- Norwich

- Worcester

- London

- Bristol

- Portsmouth

- Cardiff

- Coventry

- Sheffield

This breakdown illustrates a number of talking points. The most notable point is that the spread of cities with the higher level of inheritances is relatively wide, with a number of regions being represented. For example, York and Sheffield feature, despite Yorkshire and the Humber having one of the lowest overall levels of inheritances.

The following cities have the lowest levels of inheritance:

- Wrexham

- Aberdeen

- Brighton & Hove

- Southampton

- Glasgow

- Liverpool

- Birmingham

- Aberystwyth

- Leicester

- Plymouth

- Belfast

- Newcastle

There are three cities which undermine their respective regions positioning with regards to inheritances. Liverpool (North West), Birmingham (West Midlands) and Plymouth (South West) all have among the lowest level of inheritances despite their regions high rankings. Plymouth particularly stands out, as the South West is also one of the most expensive regions, according to average house prices.

There could be a number of potential explanations for certain regions and cities having average levels of inheritances that do not necessarily match up with the house prices in the region. For example, average age may have an impact on the amount of inheritance that is received, as regions that have a higher average age would, in theory, mean that residents have a more substantial estate to pass on to their loved ones. That is unless their estate has been reduced by the effect of high care home fees in the last years of life.

This would certainly provide some explanation as to why London only has the fourth highest level of inheritances, despite having the highest average house prices in the UK, as well as the highest average income. It does however have the lowest average age in the UK.

It’s also important to consider whether home ownership affects the statistics. Based on figures from the ONS, we can see which regions, at least in England, have the highest and lowest rates of home ownership. You would expect that regions with higher rates of home ownership would result in higher levels of inheritance.

This could explain why the West Midlands has the highest level of home ownership, despite the average house price falling below the average for the UK. In the West Midlands, home ownership is the highest in England at 68.7%.

Section 5: Claiming against non-family members

It is possible to make a claim against an estate, even if you are not related to the deceased. There are a wide range of different ‘associates’ of the deceased who could potentially bring forward a claim. In this case, we looked at statistics pertaining to the following:

- Colleague

- Neighbour

- Friend

- Carer

- Medical professional

Somewhat surprisingly, the split between these different non-family members initiating an inheritance dispute was relatively widespread. The most common non-family member making a claim for each area was:

- East Anglia – Colleague (40%)

- East Midlands – Colleague (40%)

- London – Friend (31%)

- North East – Colleague and friend (33%)

- North West – Friend (31%)

- Northern Ireland – Neighbour (64%)

- Scotland – Friend (17%)

- South East – Colleague (59%)

- South West – Colleague (55%)

- Wales – Colleague and carer (33%)

- West Midlands – Medical professional and friend (22%)

- Yorkshire and the Humber – Friend (38%)

Friends were, as might be expected, the most featured type of non-family member making claims. However, this category did not feature in either Northern Ireland or Wales. Similarly, colleagues featured heavily, though they were not present in Yorkshire and the Humber.

Section 6: Reasons for dispute

The validity of a Will and/or the administration of an estate can be contested for all manner of reasons and may be linked to the steps taken when a particular document was created, the actual contents of the document, or the actions of the personal representatives.

For each region, the most common reason for the dispute was as follows:

- East Anglia: not being happy with inheritance.

- East Midlands: not being a beneficiary and rectification.

- London: the amount in the estate not matching the amount stated in the Will, and not understanding the extent of the property.

- North East: not being happy with inheritance.

- North West: undue influence.

- Northern Ireland: the amount in the estate not matching the amount stated in the Will, and not understanding the nature of making a Will.

- Scotland: not being happy with inheritance, estate not distributed properly, not a beneficiary, and the amount in the estate not matching the amount stated in the Will.

- South East: deceased not able to comprehend and appreciate the claims to which they ought to give effect i.e. testamentary capacity.

- South West: not a beneficiary.

- Wales: estate not distributed properly.

- West Midlands:

- Yorkshire and the Humber: estate not distributed properly.

The spread of reasons for a Will dispute was evidently wide. In the vast majority of instances, the reasons of ‘forgery’ and ‘fraud’ were the least common in each region, although they did feature as a reason to varying degrees across the board.

Section 7: Legal fees

It should stand to reason that those regions with a higher average income are likely to spend more money on legal fees to resolve a case of contested probate. This is because a higher proportion of residents should, in theory, have the necessary disposable income to pay for more extensive legal support. Our prior research showed that the average value of legal fees spent was £12,775,40.

Legal Fees by Region

The vast majority of regions had a high proportion of residents spend between £1,000 and £5,000 on legal fees. In fact, only London, the South West and Wales fell outside of this bracket.

For London and the South West, this does not come as much of a surprise. Based on the figures, the largest proportion of residents in London spend between £5,001 and £10,000 on legal fees, which aligns with the fact that the Capital has the highest average income per year in the UK (£30,256). Along the same lines, London has the smallest percentage of residents spending less than £1,000 on legal fees (2%).

Interestingly, the South West has the highest proportion of residents spending between £10,0001 and £25,000 on legal fees, despite only having the fourth highest average income in the UK (£21,222).

It’s particularly interesting that Wales appears to sit above many other regions with regards to legal fees. In Wales, the highest percentage of residents spend legal fees of between £5,001 and £10,000 (32%), despite the fact that it has the second lowest average income in the UK (£17,263).

Northern Ireland has the highest percentage of residents spending less than £1,000 on legal fees, and also has the third lowest average income (£17,331).

Another stand out figure is that the North West is the region with the highest percentage of people spending more than £50,001 on legal fees (8%). This is in spite of the region only having the seventh highest average income (£18,601).

Legal Fees by City

Many of the figures relating to regions are heavily influenced by individual cities. For example, Manchester, which sits within the North West, has the highest percentage of residents spending more than £50,001 on legal fees compared to every other city in the UK – including London. Manchester’s position here is a potential explanation for why the North West is at the top for this particular figure.

The West Midlands sits relatively low on the list when it comes to average income (£18,350), but the amount of legal fees spent in the region is likely lifted by the figures relating to Wolverhampton. That city has the highest percentage of residents spending between £10,001 and £25,000 (67%).

As with the discussion relating to the average inheritance awarded following contested probates, Plymouth is an anomaly in this section. While the South West had a high proportion of residents spending more than average on legal fees, Plymouth has the highest percentage of people spending less than £1,000.

Section 8: Amounts successfully claimed

Our previous research demonstrated that the average value a claimant in a disputed probate case was able to recover in a successful claim was £190,793.55. Using this average as a guide, there are several interesting conclusions which can be made regarding each individual area of the UK and the amount recovered following a successful claim.

Successful Claim Values by Region

Keeping this average figure in mind, various conclusions can be drawn. The following regions had the highest percentage of respondents for each band:

- Less than £1,000 – Northern Ireland

- £1,000 – £5,000 – East Midlands

- £5,001 – £10,000 – Wales

- £10,001 – £50,000 – South East

- £50,001 – £100,000 – North East

- £100,001 – £300,000 – East Anglia and South West

- £300,001- £500,000 – Northern Ireland

- £500,001-£750,000 – North East

- £750,001 – £1,000,00 – West Midlands

- £1,000,001+ – North West

It’s particularly interesting that Northern Ireland has the largest proportion of successful claims worth less than £1,000, as well as between £300,001 and £500,000. This indicates a huge spread in terms of the value of these claims, as well as demonstrating that factors such as average house price and average income do not necessarily have an influence over the potential claim value after contesting a will/probate.

This is further supported by the fact that the North East has the highest percentage of claims worth between £500,001 and £750,000. The region has the lowest average income in the UK, as well as the lowest average house price, at £147,214.

London, the region with the highest average income and house prices, does not feature in any of the tiers for higher value claims. Instead, a more even spread across the tiers has prevented this from being possible.

Successful Claim Values by City

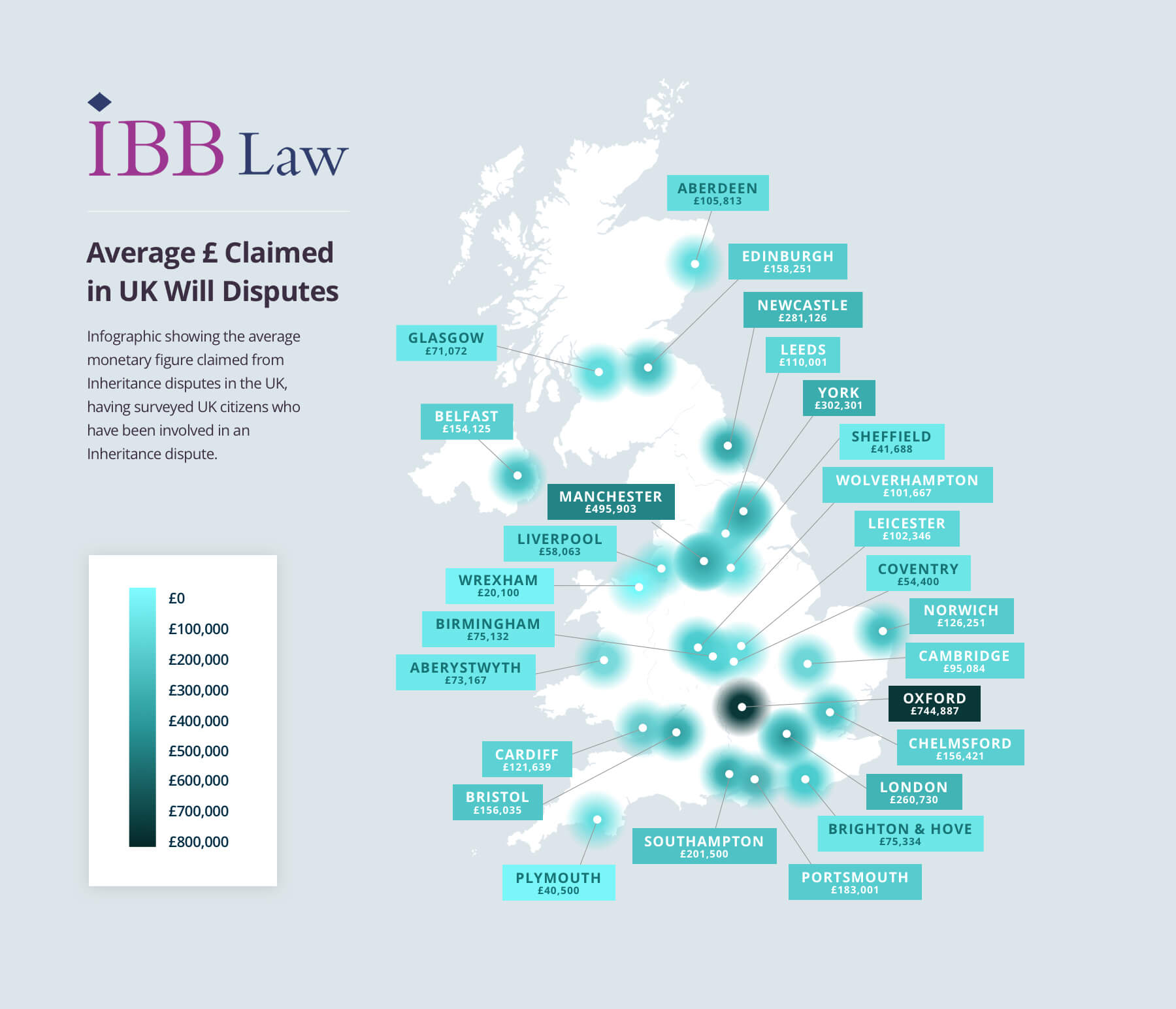

Here, we’ve provided another infographic which highlights the average amount claimed in each UK city:

One figure which immediately stands out concerns Manchester. A staggering 21% of successful claims in the city were worth more than £1,000,000, which is 15% higher than any other city in the UK. This is the most obvious explanation for the North West being the region with the highest proportion of claims being in excess of this value.

Similarly, Newcastle has the highest percentage of residents successfully claiming between £500,001 and £750,000 at 19%, which would provide an explanation as to why the North East leads the way in this bracket.

Overall, Oxford has the highest average amount claimed out of any UK city, at just under £750,000.

Section 9: Debt

When someone passes away, any debts which were unpaid will become a liability of their estate. The personal representative of the estate will usually be responsible for paying these debts.

Debt by Region

Where debt was a factor, in each UK region the following were the most common types that needed to be dealt with:

- East Anglia: Fuel bills.

- East Midlands: Tax debts and business loans.

- London: Credit card.

- North East: Business loans and fuel bills.

- North West: Credit card, business loans and personal loans.

- Northern Ireland: Mortgage and business loans.

- Scotland: Mortgage and business loans.

- South East: Credit card and mortgage.

- South West: Rent arrears.

- Wales: Credit card and business loans.

- West Midlands: Tax debts.

- Yorkshire and the Humber: Credit card, mortgage, tax debts, personal loans and overpaid pension.

In theory, there should be a link between the type of debt that is most common in each area and the average value of the debt. Here is a look at the most common value of debts in each area:

- East Anglia – £1,000 to £5,000

- East Midlands – £1,000 to £5,000

- London – £50,001 to £100,000

- North East – £10,001 to £50,000

- North West – £100,001 to £300,00

- Northern Ireland – £50,001 to £100,000

- Scotland – £1,000 to £5,000

- South East – £50,001 to £100,000

- South West – £100,001 to £300,000

- Wales – £5,001 to £10,000

- West Midlands – £10,001 to £50,000

- Yorkshire and the Humber – £10,001 to £50,000

The most common type of debt in the South West was rent arrears, with this area also having the highest percentage of debts in the region of between £100,001 and £300,000. This could tell us a number of things, with one potentially being that the cost of rent in the region is disproportionately high compared to levels of average income.

This is further demonstrated when looking at the city of Bristol, which follows a very similar pattern, with rent arrears being the second most common type of debt, and the most common debt being worth between £100,001 and £300,000.

The highest percentage of debts in the North West also sit between £100,001 and £300,000. In this region, the most common type of debt was a split between credit cards, business loans and personal loans. It is interesting to note that business and personal loans both feature, which could suggest that residents in the North West are more likely to receive loans from lending platforms that they may struggle to repay – leaving the debts with the personal representatives of their estate.

In London, the highest percentage of debts sits between £50,001 to £100,000. While, comparatively, this means that it is not the region with the most valuable debts, it is worth noting that the most common types of debt here involved credits cards and mortgages. This would suggest that the potential spending habits, or credit limits, of residents in London may be above what they can realistically afford.

Debt by City

As has been the case in a number of sections in the study, Manchester once again stands out. The most common values of debt in this region, both standing at 25%, were £1,000,000+ and £100,001 – £300,000

Oxford had the highest proportion of debts worth between £750,001 and £1,000,000, which is coupled with the fact that, in the South East region, credit cards and mortgages were the most common forms of debt.

Leeds had the highest proportion of debts worth less than £1,000, which also supports the fact that the wider Yorkshire and the Humber area had a higher proportion of debts within this same bracket than any other region – though overall it most commonly saw debts of between £10,001 and £50,000. This number was likely increased by the fact that, in York, 50% of debts fell within the £750,001 and £1,000,000 bracket.

Section 10: Inheritance Act Claims

The Inheritance (Provision for Family and Dependants) Act 1975 has a huge bearing on the way probate is handled and what someone may be entitled to claim. It can mean that certain dependants of the deceased are financially supported after their death.

However, the figures relating to this particular legislation indicate that awareness of the Inheritance Act claims varies significantly between regions and cities. The breakdown is as follows, with “Yes” being that the survey respondent had heard of the Act and “No” being that they had not:

- East Anglia: Yes (71%) No (29%)

- East Midlands: Yes (48%) No (52%)

- London: Yes (78%) No (22%)

- North East: Yes (62%) No (38%)

- North West: Yes (78%) No (22%)

- South East: Yes (57%) No (43%)

- South West: Yes (60%) No (40%)

- Wales: Yes (70%) No (30%)

- West Midlands: Yes (69%) No (31%)

- Yorkshire and the Humber: Yes (42%) No (58%)

As can be seen, in England and Wales, London and the North West are the regions with the highest awareness of the Inheritance Act, whereas Yorkshire and the Humber demonstrates the lowest awareness.

When it comes to the cities in the UK, the distribution for awareness of the Inheritance Act was as follows:

Taking cities into account, there are a number of interesting pointers. On one end of the scale, 100% of respondents from Wrexham claim to be aware of the Inheritance Act, countering the more balanced responses from other Welsh cities, Cardiff and Aberystwyth.

On the other end of the scale, just 42% of respondents from Sheffield have heard of the Inheritance Act, which is the lowest out of any city in England and Wales.

What To Do if You Are Involved in an Inheritance Dispute

With the right legal guidance in place, and a thoroughly detailed approach, many contentious probate matters and inheritance disputes can be resolved swiftly, often without the need for court proceedings. This remains the case, no matter what the dispute involves, or the value of the estate.

At IBB Law, we have decades of combined experience and specialist expertise in handling a wide range of Wills, trusts and probate disputes and Inheritance Act claims. Our team have particular expertise in handling matters involving high value estates and foreign assets, seeking creative and effective solutions to even the most complex disputes.

We are fully accredited, and a member of the Law Society’s Wills and Inheritance Quality Scheme (WIQS) and ACTAPS, providing a best practice quality mark for Wills and estate administration advice that consumers can trust.

Get in touch with our contentious probate team.

To speak to a member of our expert team about a Will dispute, or any other related matter, contact us today by calling 0330 175 7615 or email us at enquiries@ibblaw.co.uk.

Methodology

Our survey was conducted by OnePoll. It involved 1,000 respondents across the UK, all of which had dealt with contentious probate in the past ten years (whether they were the claimant or someone else was the claimant against an estate in which they were involved in). The research fieldwork took place on 11th January 2021 to 28th January 2021.

OnePoll is an independent market research agency that employs MRS-certified researchers and adheres to the MRS Code of Conduct.

England and Wales do not have the same legal system for wills and probate as Scotland and Northern Ireland. Any data comparing these locations is for comparative purposes only, and does not imply that they are in the same jurisdiction.